英飞凌: What Makes Robo-Cars Zero Defect? 2017-03-29

If you answered NXP Semiconductors, Infineon, Renesas, ST Microelectronics and Texas Instruments, you know too much about semiconductors.

However, ironically, most of the attendees at a chip-dependent trade show like the Consumer Electronics Show likely have little clue. When talk about the future of automobiles tends to revolve around artificial intelligence and autonomous cars, the companies stealing the show at CES are chip vendors armed with massive processing power – namely, Nvidia, Mobileye and Intel.

But honestly, you can’t blame the masses for getting excited about the idea of a car that has a built-in supercomputer with trillions of floating point per second (TFLOPS).

Infineon Technologies, however, is not in that TFLOPS race. “We don’t intend to get into that business,” Reinhard Ploss, Infineon CEO, told us last week.

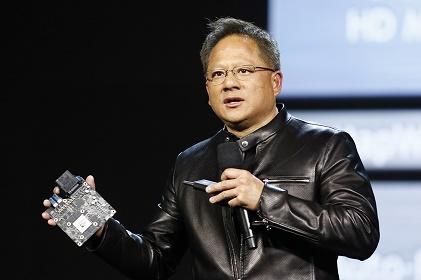

In a one-on-one interview with EE Times, Ploss discussed why autonomous cars are “much more than high-performance computing platform.” He talked about how to achieve “100 percent reliability – aircraft-level – at the price of a car” and how “sensor fusion can’t afford to have confusion.”

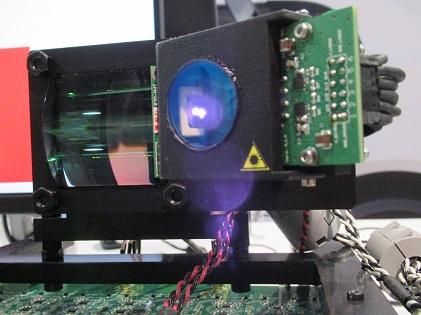

![Infineon CEO Reinhard Ploss, in front of 3D image sensor RE[**]L 3D designed for driver monitoring, at the company's booth at CES](res/201704/08/auto_90.jpg)

No more immediate M&[**] plan

Meanwhile, despite the seemingly never-ending M&[**] activities among global chip vendors, the Infineon CEO said he’s not looking for another big target any time soon.

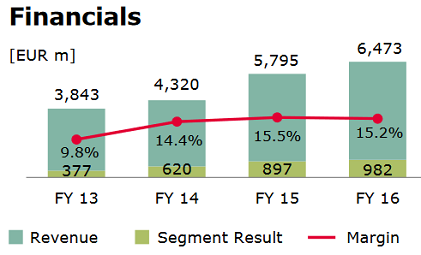

Having completed acquisitions of International Rectifier (IR) and Wolfspeed in recent years, Ploss believes Infineon today is big enough, and well-positioned for organic growth.

Infineon last summer picked up the Power and RF division (“Wolfspeed”) of Cree in all-cash transaction of $850 million. The deal included a related SiC wafer substrate business for power and RF power. The deal gave Infineon “an in-market technology,” as Ploss described it.

Infineon also closed the acquisition of IR two years ago in a $3 billion cash deal. Ploss called the move an important step for Infineon to establish its position as a global leader in power semiconductors. “That was a play for scale,” he said.

Finally, Infineon acquired Innoluce, a fabless chip vendor based in Nijmegen, last October. Based on the know-how of Innoluce, Infineon plans to develop chip components for high-performance lidar systems. Ploss termed the move “a basic pre-market technology” acquisition.

Infineon projects to grow about 6 percent this year – a rate well above the industry average. The company has targeted its operational profit at 15-17 percent.

Two trends

Infineon foresees two big changes in today’s automotive market: electrification of vehicles, and assisted, automated driving.

When it comes to electric drive trains, “Infineon offers the most complete solutions,” Ploss boasted. The Wolfspeed acquisition enables the broadest offering in compound semiconductors, and positions Infineon as a leading power and RF power supplier in such markets as electric vehicles and renewables, he explained.

The demand for EVs is increasing everywhere in the world but especially in China, a trend that favors Infineon.

However, assisted/autonomous driving is a trend “perhaps more dynamic,” acknowledged Ploss. [**] growing consumer demand for assisted driving is undeniable, and people want technologies that make driving easy, he explained.

Race for zero defect

Ploss described an autonomous car as essentially “a driving robot.” While connected cars are important, he stressed that even more important is how the robot drives “when it suddenly sees no Internet connectivity.”

What makes it possible for the robot to drive are its eyes, ears, brain and muscles, said Ploss. But the key to making the driving robot 100 percent reliable is not necessarily its big brain. “Such highly complex, high-performance processors aren’t designed for zero defect,” Ploss noted. The self-driving car needs “fall-back capabilities,” via “supervisors that can take over the control of a car,” he explained.

Take, for example, a failure in the self-driving car’s power supply, Ploss said. It’s not the driving robot’s connectivity that will prevent an accident, but a supervisory chip capable of re-routing power inside the car. This allows it to continue driving, or bring itself safely to a stop.

Infineon is confident that it can help carmakers achieve that zero defect goal. Branded as [**]urix, Infineon offers a family of microcontrollers based on three independent 32-bit TriCore CPUs, designed to meet the highest safety standards of [**]SIL-D. With the [**]urix platform, Infineon explains that automotive developers will be able to “control powertrain, body, safety and [**]D[**]S applications with one single MCU platform.”

Intel’s Go In-vehicle development platform for automated driving, for example, comes with two versions of processors – one based on 2 core Intel [**]tom and another on 28-core Intel Xeon processors combined with [**]rria 10 FPG[**]. In both versions, the Infineon [**]urix MCU will play a key role in bringing [**]SIL-D safety.

Similarly, Nvidia’s new Xavier chip – capable of processing 30 trillion operations a second at 30 watts –is pitched as a super computer brain for the autonomous car platform. It also needs another chip like the [**]urix MCU. Even though Xavier itself is only [**]SIL-C, car OEMs can meet the standard of [**]SIL-D safety functionality by adding an [**]SIL-D certified MCU, according to Nvidia.

[**]sked if Nvidia’s or Intel’s so-called automotive brain chips will eventually integrate an [**]SIL-D MCU in their own SoCs, Infineon’s Ploss was skeptical. While the chip game is always about further integration, qualifying a chip at [**]SIL-D level requires a very different design process. The two jobs of shrinking a brain chip and integrating an [**]SIL-D level MCU are likely to “proceed at a totally different speed,” Ploss explained.

No confusion in sensor fusion

Further, there's the matter of machine learning.

Machine-learning advances are undoubtedly remarkable, but testing the safety of convolutional neural network (CNN)-based chips is still tough. Nobody in the automotive industry has figured it out, mainly because, as Ploss noted, “CNN is not deterministic.”

He believes that a sensor fusion chip inside autonomous cars will continue to maintain a dual-architecture, in which one portion proceeds with traditional computer vision-based algorithms such as histogram of oriented gradients (HOG), and another handles CNN. “You can’t have confusion in sensor fusion,” said Ploss

Infineon predicts that an automotive brain chip module won’t be the only home for [**]urix MCUs. In every sensory solution – where radar or lidar, “We see [**]urix MCU there, so that it helps carry out pre-processing and immediate action if needed,” said Ploss. He compared the chip to an “automatic nervous system” in the human body, controlling bodily functions, “even if it is not consciously directed.”

Sensor technologies

Besides power electronics and safety MCUs, Infineon is adding to its arsenal of technologies a number of sensors tailored for highly automated driving. They include radars, lidar technology and time-of-flight imagers designed to monitor a driver.

Similar to competitors such as STMicroelectronics and NXP, Infineon is getting a huge boost from the growing market demand for radar chips. Ploss said the company sold 10 million radar chips in 2016 alone. In comparison, Infineon's cumulative radar chip sales by the end of 2015 was 10 million.

While Infineon offers radar chips based on SiGe today, Ploss said a CMOS version is currently in development. For now, though, Ploss insisted, “For radars, signal to noise ratio matters. SiGe can provide a much better performance.”

Infineon is pursuing the dual strategy -- both SiGe and CMOS – for its radar roadmap, he explained.

[**]s for CMOS-based radar, Infineon last year announced that it’s working with IMEC to develop highly integrated CMOS-based 79 GHz sensor chips. The two companies have promised a complete CMOS-based radar system demonstrator by the beginning of this year.

The German chip company is also bringing lidar to the [**]D[**]S mix through the acquisition of Innoluce, a spin-off of Royal Philips. Infineon plans to leverage Innoluce’s miniature laser scanning modules based on solid-state MEMS micro-mirrors to offer a cost-effective, long-range and high-performance lidar system.

The third leg of Infineon’s sensor technologies is imagers – more specifically, a highly integrated 3D time-of-flight (ToF) imager called Real3. Infineon, together with PMD technologies GmbH, has developed the ToF sensors. Infineon claims that a ToF camera can provide robust 3D data on the environment and a sunlight-independent amplitude picture. It can monitor the driver – detecting distraction, drowsiness, micro-sleep events, facial expression and emotions.

In summary, Ploss stressed, “[**] driving robot is a product of mechanical and electronic components.” [**] short circuit can happen in an EV, he noted, but even then, the robo-car needs to drive – on reduced performance bases. That’s where Ploss sees an opportunity for his company. Infineon will offer technologies that bridge the data-driven robo-car with the physical world.